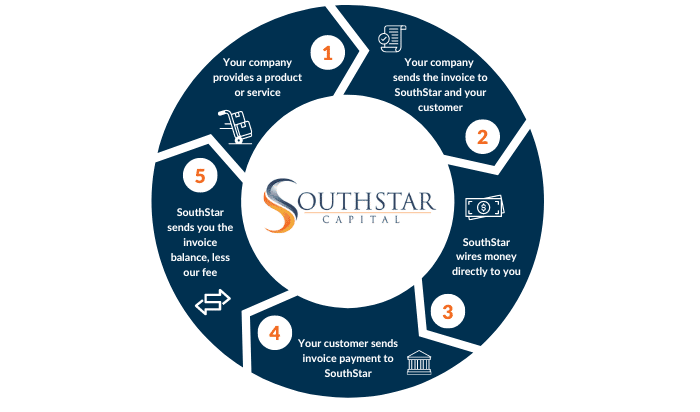

Invoice Factoring is a financial transaction that allows businesses to convert outstanding invoices into immediate cash. At SouthStar Capital, we make the process straightforward and beneficial for your business. Here’s a step-by-step guide to our invoice factoring process:

Step 1: Your Company Provides a Product/Service

The first step in the invoice factoring process begins with your company providing a product or service to your customer. This could be anything from manufacturing goods, offering consulting services, or delivering any other value your business specializes in. The key is that this transaction creates a valid, collectible invoice.

Example:

You own a manufacturing business and deliver a large order of custom machinery to a client. This delivery generates an invoice for $50,000 due in 30 days.

2. Your Company Sends the Invoice to SouthStar and Your Customer

Once the product or service has been delivered, you generate an invoice for the transaction. Instead of waiting for the customer to pay you directly, you send this invoice to SouthStar Capital and a copy to your customer.

3. SouthStar Wires Money Directly To You

Upon receiving and verifying the invoice, SouthStar Capital advances you a significant portion of the invoice value, typically between 80-90%. This means you get immediate access to the cash you need to keep your business operations running smoothly.

4. Your Customer Sends Invoice Payment to SouthStar

Your customer will pay SouthStar Capital directly. This ensures that the factoring process is seamless and straightforward for both you and your client.

5. SouthStar Sends You the Invoice Balance, Less Our Fee

Once SouthStar Capital receives the full payment from your customer, we remit the remaining balance of the invoice to you, minus our fee.

Our Process

Learn more on how to grow your business with Invoice Factoring.