SouthStar’s Recent Working Capital Solution

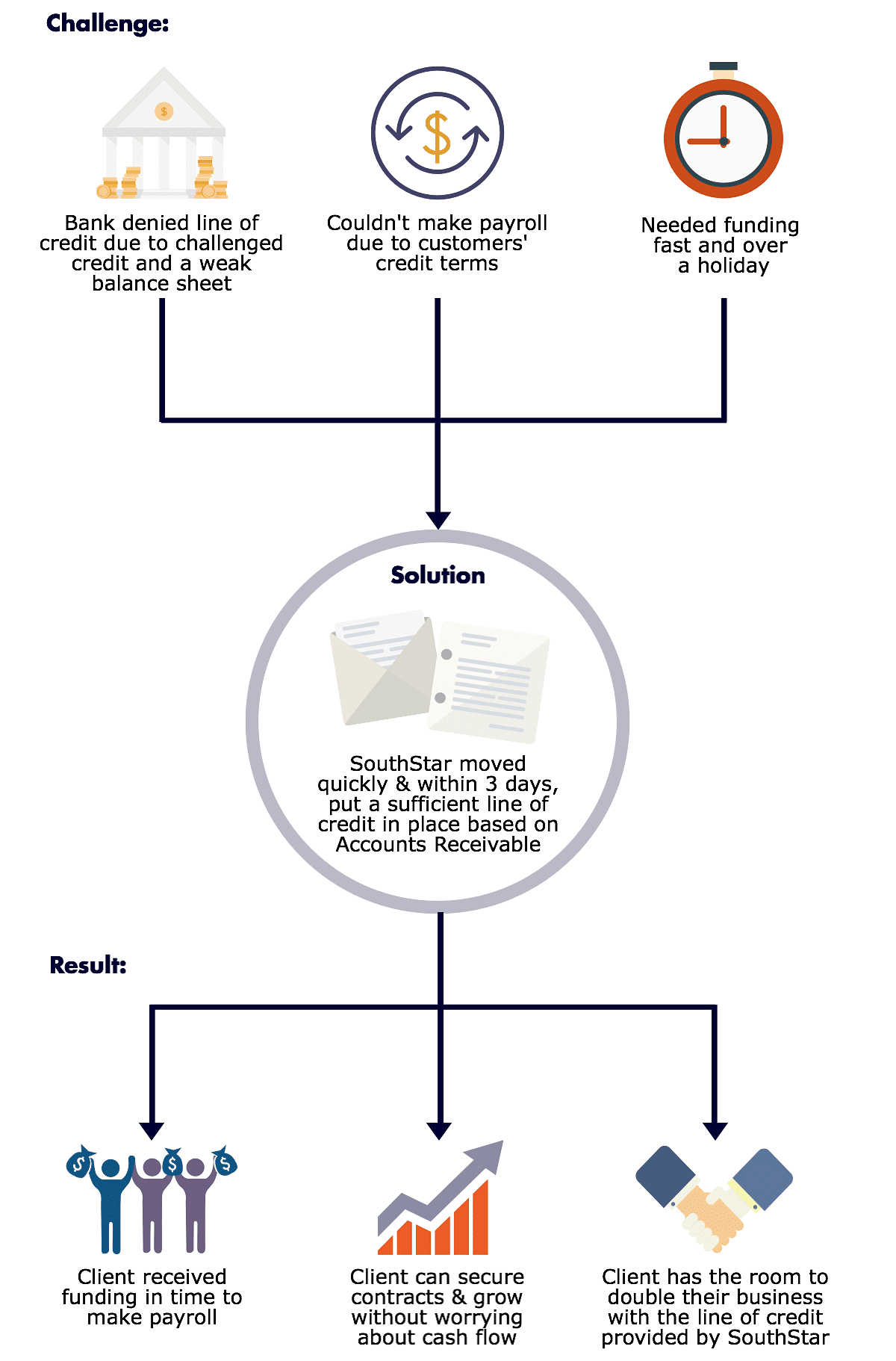

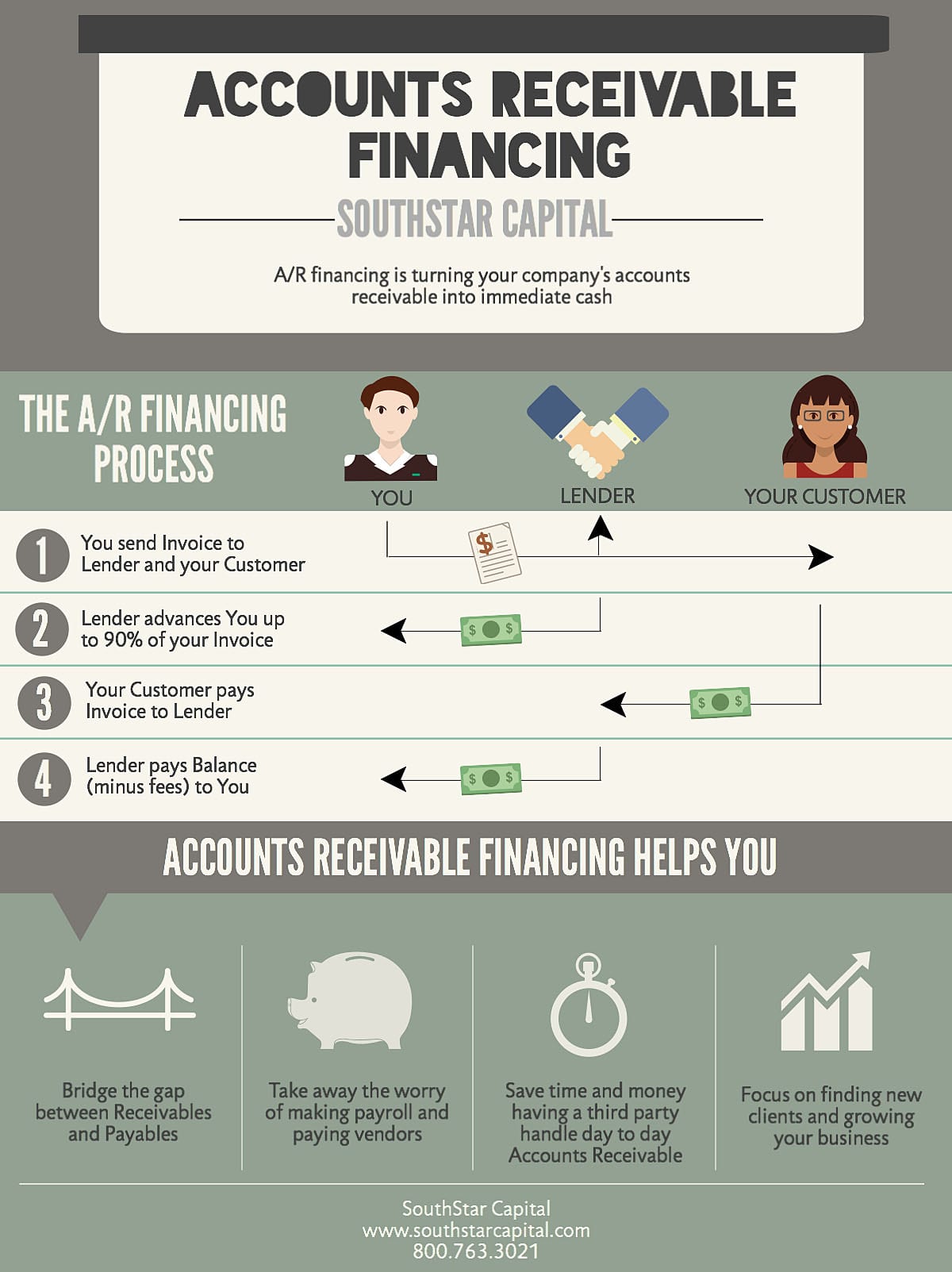

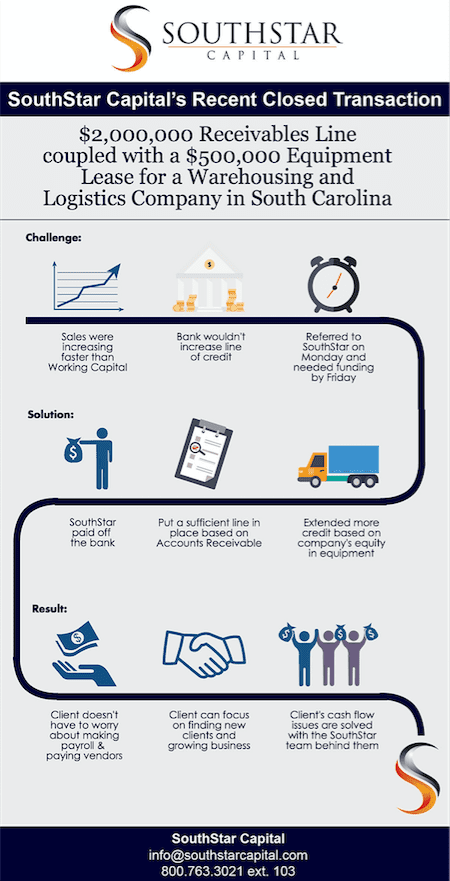

Providing alternative solutions to businesses in need of a fast and reliable source of working capital. Below is one of our recent funding solutions that provided our client with the working capital needed to ensure the growth and success of their business. $1,000,000 Receivables Line coupled with a $350,000 Equipment Lease, along with a Brokerage Line of $500,000 and a $100,000 Term Note for a Trucking and Storage Company Contact us today to discuss the working capital options available to your business. CONTACT US TODAY!